Mortgage calculator for paying down principal

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. To show you how this works lets compare two 30-year fixed mortgages with the same variables.

Mortgage Payoff Calculator With Line Of Credit

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

. You can also try reducing PMI by. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. You can also build equity in your home more quickly.

Our mortgage payment calculator shows you how much youll need to pay each month. If you choose well also show you estimated property taxes and homeowners insurance costs as part of your monthly payment. Paying off your mortgage may seem like a distant dream at first.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. Lets dive into each method of paying off your mortgage early in a little bit more detail. By paying more each month youll pay off the entirety of the loan earlier than the scheduled time.

Borrowers need to hold this insurance until the loans remaining principal dropped below 80 of the homes original purchase price. These loans have lower down payment options for home buyers. Before you begin making extra principal payments on your mortgage its best to consider your overall financial goals.

Our calculator includes amoritization tables bi-weekly savings. An amortization schedule shows your monthly payments over time and also indicates the portion of each payment paying down your. A down payment of 20 or more helps you get a lower interest rate and avoid paying private mortgage insurance.

Free mortgage calculator to find monthly payment total home ownership cost and amortization schedule with options for taxes PMI HOA and early payoff. See a complete mortgage amortization schedule and calculate savings from prepaying your loan. If you cant postpone the purchase until you can pay cash plan to make a down payment of 1020 of the home price 510 if youre a first-time home buyer.

Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. A general rule-of-thumb is that the higher the down. But you may not need that much.

One way of paying off your mortgage earlier than the term of your mortgage is to make 13 payments per year instead of. You can even compare scenarios for different down payments amounts amortization periods and variable and fixed mortgage rates. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI.

Our free mortgage calculator gives you an idea of how much you can expect to pay for a mortgage in 2022. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI. Fixed-rate conventional loans usually require a down payment of at least 3.

The mortgage payment estimate youll get from this calculator includes principal and interest. Check out the webs best free mortgage calculator to save money on your home loan today. For more information about or to do calculations involving VA mortgages please visit the VA Mortgage Calculator.

Of course because youre paying the entire loan back in only 15 years your premiums will be. This calculator doesnt include mortgage insurance or. This is the best option if you plan on using the calculator many times over the.

Some lenders also require you to include your real estate taxes and home insurance in the payment. Paying cash for a home may sound weird but imagine all the fun youd have without a mortgage payment weighing you down. Mortgage Calculator zip file - download the zip file extract it and install it on your computer.

Try out different inputs for the home price down payment loan. But what exactly does paying the extra principal do for you. The home loan calculator accounts for mortgage rates loan term down payment more.

Making just one extra payment towards the principal of your mortgage a year can help take years off the life of your loan. When you make extra principal payments on your mortgage you knock down the principal balance. Found on the Set Dates or XPmts tab.

Thats the good news. Make one extra payment every year. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or.

Youll Pay Less Interest. Your mortgage can require. Ways to pay down your mortgage principal faster 1.

Get Matched with a Lender Click Here. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. Use this mortgage calculator to estimate how much house you can afford.

We used the calculator on top the determine the results. Make One Extra Payment Per Year. Paying principal each.

Paying extra principal is a great way to get ahead. Paying a larger down payment of 20 or more if possible usually lead to qualification for lower. The good news is as you continue to make mortgage payments and the principal is reduced a higher portion of your payments will go toward paying down the mortgage principal.

It includes the principal interest and required mortgage insurance. If you buy a home for 400000 with 20 down then your principal loan balance is 320000. This method reduces the total amount of interest you pay while helping you fast-track your mortgage payoff.

A mortgage is a loan you borrow to buy a home. You use the mortgage in addition to your down payment to buy a home. This is the best option if you are in a rush andor only plan on using the calculator today.

Putting 20 down lets you avoid paying for private mortgage insurance PMI. You can make extra payments regularly or a lump-sum payment toward the mortgage principal to reach that 20 sooner. About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency.

Assess any money that you can foresee needing in the future college tuition a vacation a newused car home repairs. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. This is the amount you borrowed from the bank.

The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. How much do I need to put down. Using the 250000 example above enter 50 in the monthly principal prepayment field then either hit tab or scroll down to click.

The best way to buy a home is with 100 down. Four alternatives to paying extra mortgage principal. 30-Year Fixed Mortgage Principal Loan Amount.

First Payment Due - due date for the first payment. Mortgage Closing Date - also called the loan origination date or start date. See how changes affect your monthly payment.

Only two other entities the USDA and Navy Federal allow the purchase of a home without a down payment. Our mortgage calculator reveals your monthly mortgage payment showing both principal and interest portions. Estimate your monthly payment with our free mortgage calculator and apply today.

How to pay off your mortgage faster. Thats because any interest owing is paid first. Consider how long you plan on living in the home.

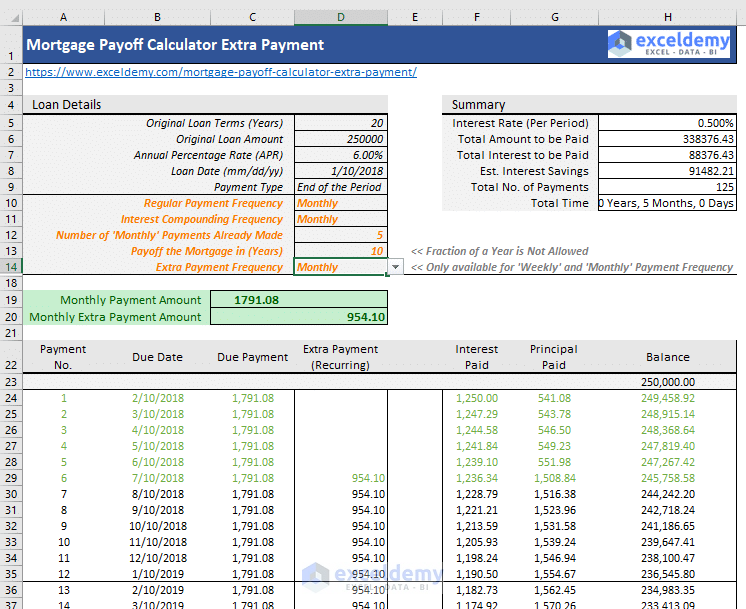

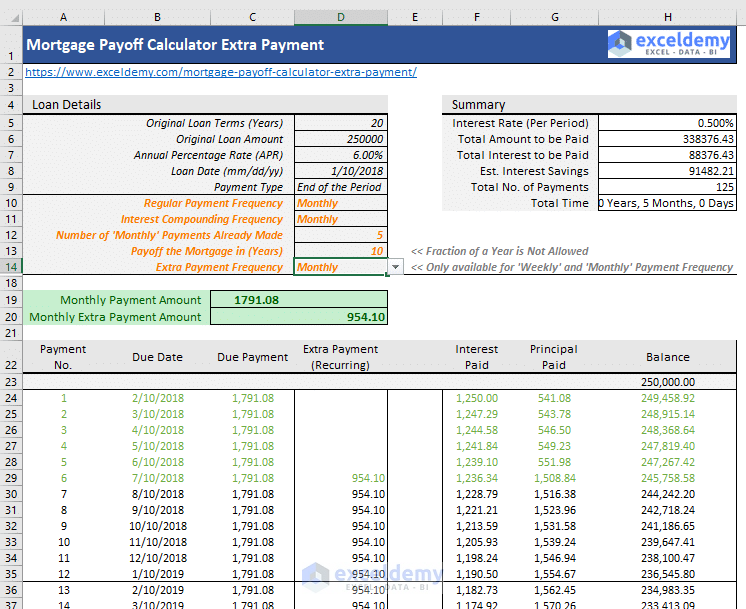

Mortgage Payoff Calculator With Extra Payment Free Excel Template

Simple Mortgage Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Amortization With Paydown Savings Calculator Spreadsheetman Spreadsheet Gallery

Downloadable Free Mortgage Calculator Tool

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Extra Payment Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator With Pmi Mortgage Calculator

Loan Repayment Calculator

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Mortgage Calculator How Much Monthly Payments Will Cost

Loan Repayment Calculator Personal Loans Mortgages Repayments Disabled World

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Mortgage Repayment Calculator